Now Reading: Dow, S&P 500, Nasdaq whipsaw as bond yields surge, China-US commerce struggle in focus

-

01

Dow, S&P 500, Nasdaq whipsaw as bond yields surge, China-US commerce struggle in focus

Dow, S&P 500, Nasdaq whipsaw as bond yields surge, China-US commerce struggle in focus

The rising theme from this week’s tariff-sparked whiplash on Wall Avenue is whether or not the volatility in US bonds and the greenback indicators waning urge for food for US belongings and their position as a secure haven asset.

The US Greenback Index (DX-Y.NYB), a key measure of the greenback’s power in opposition to a basket of main currencies, fell bellow the 100 stage, to its weakest level since April 2022.

In the meantime the 10-year yield (^TNX) surged to its highest stage since February to commerce at round 4.53%, a large 66 foundation level swing from Monday’s low of three.87%. When demand for bonds decrease, their yields rise.

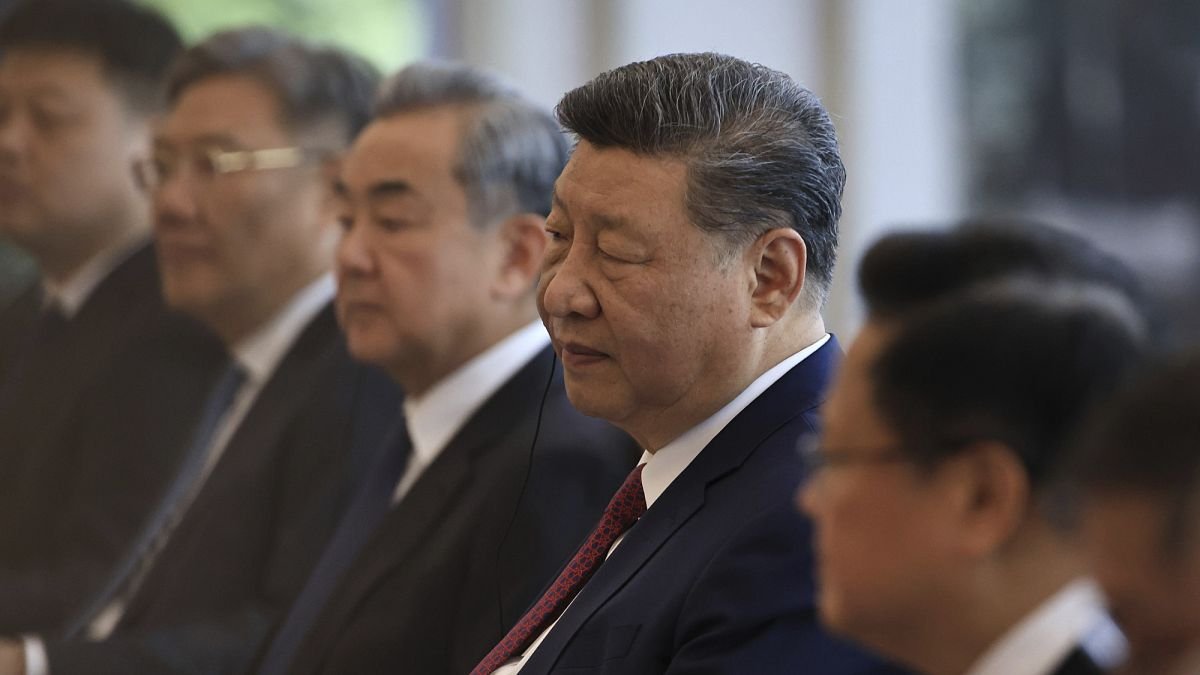

The strikes this week had been sparked by escalating commerce tensions between the Washington and Beijing as every has the US raised tariffs in opposition to Chinese language items and China elevated levies on American imports.

“Past commerce frictions, there’s a worrying pattern: a decline within the attraction of the greenback and U.S. Treasury bonds as safe-haven belongings,” wrote Quasar Elizundia, analysis strategist at Pepperstone.

“Traditionally, throughout instances of world uncertainty, these devices attracted capital looking for security. Nevertheless, present dynamics counsel a disconnect. Even amid international turmoil, the sentiment towards the greenback and Treasuries as secure havens is popping adverse—an indication that one thing basic could also be shifting.”

Maybe implementing that sentiment is the rise in gold (GC=F) surged above $3,200 on Friday to hit a contemporary document.