Now Reading: Stock Rally Stumbles as Inflation Report Tempers Rate-Cut Hopes; Dow Slips, S&P Ticks Higher for 3rd Straight Record Closeas Hot Inflation Report Tempers Rate-Cut Hopes; Dow Slips, S&P Ticks Higher for 3rd Straight Record Close

-

01

Stock Rally Stumbles as Inflation Report Tempers Rate-Cut Hopes; Dow Slips, S&P Ticks Higher for 3rd Straight Record Closeas Hot Inflation Report Tempers Rate-Cut Hopes; Dow Slips, S&P Ticks Higher for 3rd Straight Record Close

Stock Rally Stumbles as Inflation Report Tempers Rate-Cut Hopes; Dow Slips, S&P Ticks Higher for 3rd Straight Record Closeas Hot Inflation Report Tempers Rate-Cut Hopes; Dow Slips, S&P Ticks Higher for 3rd Straight Record Close

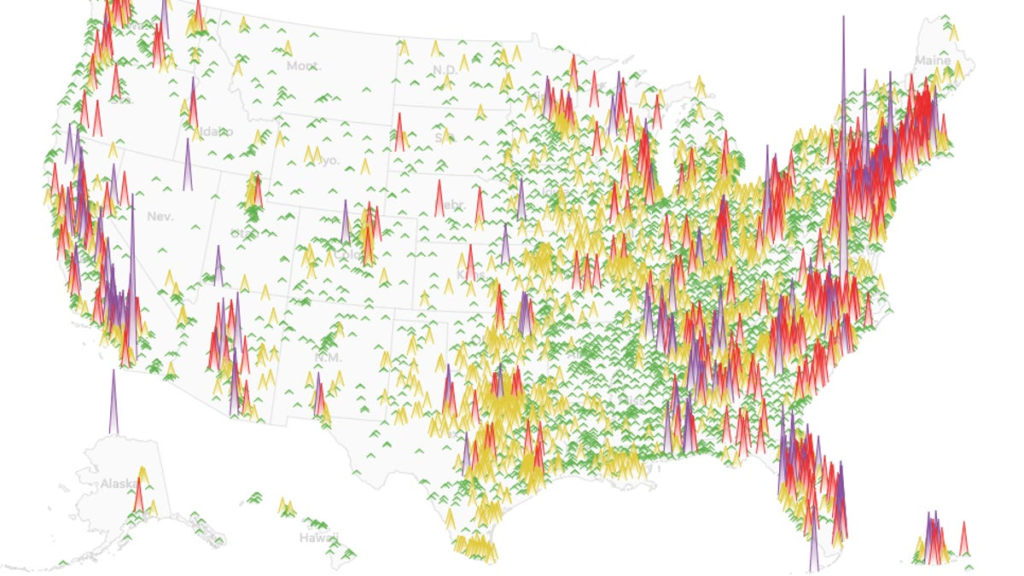

Biggest S&P 500 Movers on Thursday

6 minutes ago

Advancers

- Intel (INTC) shares gained the most of any S&P 500 stock on Thursday, surging 7.4% after a report the Trump administration is in talks with Intel about potentially taking a stake in the struggling chipmaker. That extended a rally for the stock following Monday’s meeting between CEO Lip-Bu Tan and President Donald Trump.

- Eli Lilly (LLY) said it would raise prices in Europe. Separately, the drugmaker said it will partner with Superluminal Medicines on the discovery of new weight-loss treatments using Superluminal’s artificial intelligence platform. Shares of the pharmaceutical giant ended 3.6% higher on Thursday.

- Shares of Texas Pacific Land (TPL) climbed 3.4% after the real estate operator announced a dual listing of its stock on NYSE Texas, the recently launched, fully electronic equities exchange based in the Lone Star State. An owner of significant acreage in the oil-rich Permian Basin, Texas Pacific Land has been exploring opportunities to diversify its revenue stream beyond oil and gas royalties through projects including cryptocurrency mining and data centers.

Decliners

- Shares of Tapestry (TPR), parent company of the Coach, Kate Spade, and Stuart Weitzman brands, plunged nearly 16%, retreating from Wednesday’s record-high close to log the S&P 500’s weakest performance on Thursday. Although the maker of luxury handbags and other fashion accessories beat fiscal fourth-quarter sales and profit estimates, boosted by demand for Coach bags, Tapestry slashed its fiscal 2026 profit outlook, citing an anticipated $160 million negative impact from tariffs.

- Global packaging company Amcor (AMCR) missed sales and profit estimates for its fiscal fourth quarter, and its shares dropped about 12%. The company said its quarterly performance reflected integration costs related to Amcor’s acquisition of packaging rival Berry Global, which closed in April 2025. The company also pointed to operational challenges in its beverage business in North America and indicated that restrained consumer spending on discretionary items like snacks and sweets weighed on volumes for its rigid and flexible packaging solutions.

- Shares of The Trade Desk (TTD), which provides tools to help advertisers optimize their digital campaigns, fell 6.6%. The downturn followed a report that Walmart (WMT) was modifying its partnership with the advertising technology firm, stepping away from an arrangement that required companies to use The Trade Desk’s platform to access customer data. The reported loss of exclusivity with the retail giant comes at a challenging time for The Trade Desk—the stock plummeted late last week after the firm fell short of estimates with its quarterly results, citing tariff-related uncertainty.

–Michael Bromberg

Intel Pops on Report Government Considering Taking a Stake

23 minutes ago

Intel (INTC) shares surged Thursday following a report that the Trump administration is considering taking a stake in the struggling chipmaker.

Trump’s team has discussed plans that could see the administration throwing its support behind an expansion of Intel’s domestic manufacturing capabilities, Bloomberg reported Thursday, citing people familiar with the matter.

White House Spokesperson Kush Desai told Investopedia such discussions “should be regarded as speculation unless officially announced by the Administration.” Intel did not immediately respond to a request for comment.

Shares of the chipmaker jumped over 7% during Thursday’s regular session and rose another 4% in extended trading, adding to gains earlier in the week amid speculation about a deal after a promising meeting between CEO Lip-Bu Tan and President Trump.

Alex Wroblewski / Bloomberg / Getty Images

President Trump praised Tan’s “amazing story” on social media following the Monday meeting, just days after calling for Tan’s resignation, and said Tan would spend more time with officials and “bring suggestions to me during the next week.”

Bernstein analysts said Tuesday that the comments could mean more opportunities for Intel to win support from the Trump administration, at a time when the chipmaker is “clearly in need of help.” Tan, who took the helm of Intel in March, has moved to lower the company’s headcount and shed assets in his first few months on the job as part of his efforts to engineer a turnaround.

–Kara Greenberg

Grocery News Has Amazon Stock Delivering Gains

46 minutes ago

Amazon’s got some mojo.

The tech and retail giant’s stock has been a middling performer among the big names for much of the year. It was essentially flat in the first half, while a popular Magnificent 7 exchange-traded fund moved higher and both underperformed the benchmark S&P 500. More recently, shares of Amazon (AMZN) have shown substantial life.

They finished Thursday up nearly 3%, extending Wednesday gains and leaving them just over 5% for the year—fifth-best among the group of seven tech giants year-to-date. Behind the latest bump: enthusiasm for yesterday’s announcement that it would extend a move into fast delivery of fresh groceries, seen as a shot across the bows of other retailers and delivery companies. (Think Walmart (WMT), Instacart (CART) and Kroger (KR), for example.)

Several Wall Street analysts applauded the move, which followed a second-quarter earnings announcement that disappointed some investors. “Fresh grocery has been a significant missing piece in Amazon’s offering [versus] competitors,” Bank of America wrote, naming Walmart and Target (TGT). “With better grocery capabilities, Amazon should see important customer frequency benefits and potential lock-in.”

Morgan Stanley estimates that offline grocery spending is worth about $1.5 trillion in the U.S., or nearly half of all offline consumer spending. Fresh and perishable goods, they write, are about 45% of that total; Amazon, they said, was at risk of losing grocery market share before its latest move.

Better grocery service could also boost the value of Prime membership, according to JP Morgan analysts, who think the company could raise membership prices next year without significantly causing churn or eating into customer acquisition.

Amazon is widely liked by Street analysts, who according to Visible Alpha are unanimously bullish. The current consensus price target, near $262, suggests a roughly 13% premium to Thursday’s close. That’s a solid enough outlook—to be sure, some Magnificent Seven stocks managed double-digit gains in the first half of 2025 alone—but CNBC’s Jim Cramer, to name one observer, is now talking about a “new narrative” for the company.

Based on the stock’s latest rise, investors were eager to hear one.

–David Marino-Nachison

There Are Warning Signs in the Retail Sector

2 hr 46 min ago

Retail spending was solid in July, according to new data. But will it be enough to quell concerns about tariffs and inflation?

Retail sales, exclusive of car and gas spending, rose 1.5% from June to July, reversing a 0.3% decrease from May to June, the National Retail Federation said this week ahead of government retail data due Friday. Retail spending is a closely watched measure of consumer financial health; economists expect Friday’s report to show July sales up 0.5% from June, according to a Wall Street Journal survey.

Sales for the month rose 5.9% year-over-year, but the trade group said it was difficult to determine what drove up spending. Retail sales were relatively weak in June, NRF said, while back-to-school spending and a longer Prime Day may have inflated July’s numbers, Bank of America said.

David Paul Morris / Bloomberg / Getty Images

Executives at a range of companies have hinted at cautious consumers during the second-quarter earnings season. Wall Street analysts have suggested that shoppers have continued to spend, but sought opportunities to trade down to cheaper versions of desired items.

“It is possible some of the increase in spending was due to retailers passing through current or prospective tariff increases onto customers,” Bank of America wrote in an analysis of credit and debit card spending in July that pointed toward a smaller increase in the number of card transactions per household than in dollars spent.

Annual inflation in July was on par with the 2.7% rate reported in June, coming in just below what economists expected. Economists generally believe tariffs will lead to price increases, and potentially, spikes in inflation, though some think that companies have yet to pass along as much of the effect of tariffs to consumers as they may in the second half of the year.

Cautious consumer spending has come up on a number of retailers’ recent conference calls, including the outdoor gear company Yeti Holdings (YETI), the athletic apparel brand Under Armour (UA) and burger chains Jack in the Box (JACK) and McDonald’s (MCD). Lower-priced store-brand products have seen more take-up lately, some grocers and food companies have said.

–Sarina Trangle

The Cases For—And Against—More S&P 500 Gains

3 hr 17 min ago

Like banging the top of an old TV set could clear up static, Trump’s Liberation Day might’ve been the hard reset needed to pave the way for stocks to keep rising. But with the U.S. indexes already around highs, some watchers think the possibility of a correction is impossible to ignore.

That’s the case Jim Thorne, chief market strategist at Canadian investment firm Wellington-Altus, made in what he called the “new American framework” in a report published Tuesday. The S&P 500 could reach 7,500 by the spring of next year, Thorne wrote, implying upside of about 15% from recent levels.

As tariff policy evolved after Liberation Day, strategists who’d pulled back S&P 500 targets turned optimistic again. The rally, however, has some observers wary: Fundstrat’s head of technical strategy Mark Newton on Tuesday wrote that the S&P 500 could experience resistance after joining the Invesco QQQ Trust (QQQ), an ETF tracking the Nasdaq 100 index, at all-time highs.

Market breadth, a technical indicator used to measure market momentum, has declined since mid-July, and defensive sectors, like staples, have been advancing. The latter, Newton said, is what technical analysts tend to see before a correction.

But the U.S., Thorne argues, is “at the crossroads of fiscal transformation, technological upheaval, and a reawakening of pragmatic innovation.” That, he says, means “the chorus of Wall Street elites and bond vigilantes—those ‘reasonable’ guardians of orthodoxy—suddenly find their well-worn complaints losing traction. The unreasonable innovators, meanwhile, are busy rewriting the rules. The upshot—smart investors don’t complain, they just adapt and ignore the noise.”

An example, Thorne writes: the crypto space, which is evolving quickly, aided by regulatory clarity that is helping demand for bitcoin but also other digital assets. Wall Street and the broader financial system is getting revamped, he said; indeed, fintech platforms have started to roll out tokenized stocks, while retailers like Walmart (WMT) and Amazon (AMZN) are reportedly exploring their own stablecoins, the crypto industry’s answer to payments.

Thorne advised investors to ignore “fear-driven narratives” and position for growth with more exposure to sectors and companies in artificial intelligence, blockchain, tokenization, industrials, as well as digital asset infrastructure and financials.

–Crystal Kim

PPI Revives Concerns About Impact of Tariffs on Inflation

5 hr 1 min ago

Data on wholesale inflation is reigniting worries that price pressures from tariffs are imminent— and investors took notice.

The Producer Price Index rose 0.9% in July, well above the 0.2% increase economists expected on average.

Core PPI, which excludes foods, energy, and trade services, rose by 0.6% over the month, the largest monthly increase in the metric since March 2022.

According to last week’s report on consumer prices, businesses have broadly held off on passing increased tariff costs onto consumers. But Thursday’s data on wholesale inflation may indicate a change is coming.

“Tariff-exposed goods are rising at a rapid clip, indicating that the willingness and ability of businesses to absorb tariff costs may be beginning to wane,” said Matthew Martin, senior economist at Oxford Economics.

The PPI data could affect the Federal Reserve’s plans for cutting interest rates.

Before the inflation print was released Thursday morning, traders were pricing in nearly a 100% chance that the Fed would cut rates at its next meeting in September, according to the CME Group’s FedWatch tool. CME forecasts rate movements based on fed funds futures trading data.

After the report was released, they pulled back from that certainty. As of noon ET on Thursday, traders thought there was more than a 9% chance that the Fed officials would hold their rates steady, as they have all year. Market participants now only expect two quarter-point cuts before the end of the year, compared with the three that were being priced in yesterday.

Tom Williams / CQ-Roll Call / Getty Images

Fed officials are less sure that a rate cut is the right move, and this data could give them leeway to continue their “wait-and-see” approach.

“This emboldens those who are less dovish on the Fed that a September cut is not a done deal,” wrote BMO senior economist Jennifer Lee

–Terry Lane

Advance Auto Parts Cuts Outlook, Shares Drop

6 hr 18 min ago

Advance Auto Parts (AAP) shares shifted into reverse Thursday after the auto parts retailer lowered its profit guidance as it took on a new $1 billion loan.

The company now sees full-year adjusted earnings per share (EPS) in the range of $1.20 to $2.20, compared to its previous outlook of $1.50 to $2.50.

Advance Auto Parts announced in a regulatory filing that it had “entered into a new five year senior secured first lien asset based revolving credit facility” that provides for an extension of credit of up to $1 billion. It noted it “has a first lien on substantially all the accounts receivable, inventory, certain deposit accounts and certain related assets of the borrower and guarantors,” and replaces a previous facility.

The news offset better-than-expected second-quarter results. The company posted adjusted EPS of $0.69, while analysts surveyed by Visible Alpha were looking for $0.55. Even though revenue fell nearly 8% year-over-year to $2.01 billion, that also topped forecasts.

Comparable store sales gained 0.1%, which CEO Shane O’Kelly credited to growth in Advance Auto Part’s Pro business, and added that “we are encouraged by the early signs of stabilization in our DIY business.”

Advance Auto Parts shares were down 12% in recent trading.

–Bill McColl

Tapestry Stock Tumbles as Coach Parent Cuts Outlook

6 hr 57 min ago

Tapestry (TPR) shares plunged Thursday after the owner of fashion brands gave a weaker-than-expected outlook as it warned it would take a significant hit from new tariffs.

The parent of the Coach, Kate Spade, and Stuart Weitzman brands expects fiscal 2026 earnings per share of $5.30 to $5.45, which includes the “negative impact of incremental tariffs and duties of over $0.60.” The midpoint of the range was below the $5.42 consensus projection of analysts surveyed by Visible Alpha.

The company added that gains in operating margin would be “offset by a negative tariff and duty impact of approximately 230 basis points,” or $160 million.

The news came as Tapestry reported it set a fourth-quarter revenue record of $1.72 billion, and posted adjusted EPS of $1.04. Both exceeded estimates.

Adek Berry / AFP / Getty Images

The gains were driven by sales of Coach, which jumped 14% year-over-year to $1.43 billion. Kate Spade sales dropped 13% to $252.6 million, and sales at Stuart Weitzman fell 10% to $45.5 million.

Tapestry shares were down 13% recently, after closing at an all-time high yesterday. Even with today’s selloff, the stock is up about 50% year-to-date.

–Bill McColl

Deere Lowers Outlook on ‘Challenging’ Economic Environment

8 hr 2 min ago

Shares of Deere & Co. (DE) slumped in early trading Thursday after the big farming and construction machinery maker lowered its full-year outlook, saying “customers remain cautious.”

Deere now sees fiscal 2025 net income in the range of $4.75 billion to $5.25 billion. Previously, its outlook was for $4.75 billion to $5.50 billion.

CEO John May said its customers are facing “challenging times.” He added that the “positive outcomes we’re enabling reinforce our confidence in Deere’s future despite near-term uncertainty.”

The forecast offset better-than-expected fiscal third-quarter results. Deere posted earnings per share of $4.75 on revenue that fell 9% year-over-year to $12.02 billion but also exceeded consensus estimates of analysts surveyed by Visible Alpha.

Sales at the Production & Precision Agriculture unit sank 16% to $4.27 billion. They were down 5% to $3.06 billion at the Construction & Forestry division, and they slid 1% to $3.03 billion at the Small Agriculture & Turf segment.

Deere shares were down more than 6% in recent trading. Entering today’s session, the stock was up 21% so far in 2025.

–Bill McColl

Major Index Futures Little Changed

9 hr 51 min ago

Futures tied to the three major U.S. stock indexes were fractionally higher this morning.

Dow Jones Industrial Average futures

TradingView

S&P 500 futures

TradingView

Nasdaq 100 futures

TradingView