Now Reading: Stocks Slide on Deficit and Tariff Concerns

-

01

Stocks Slide on Deficit and Tariff Concerns

Stocks Slide on Deficit and Tariff Concerns

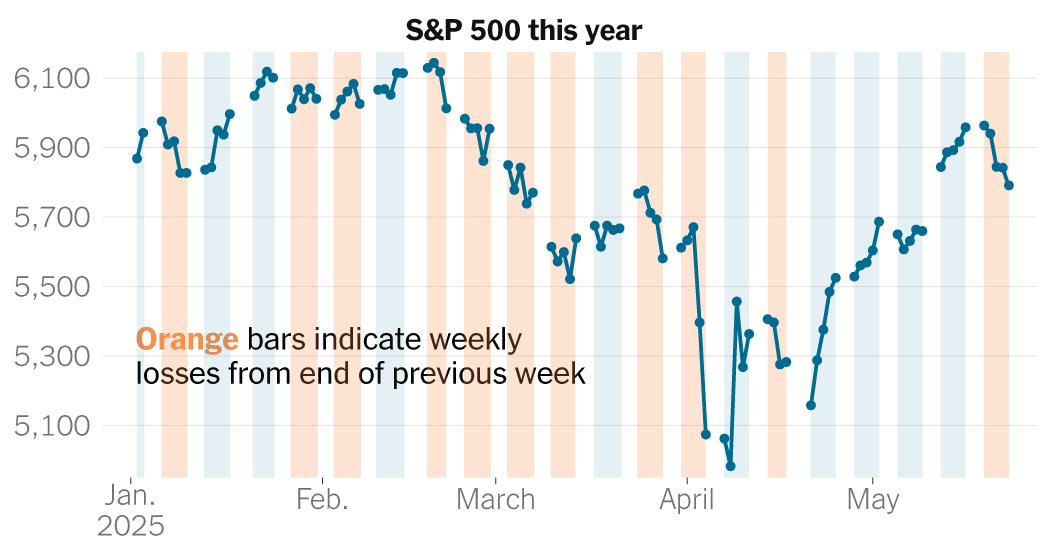

Stocks on Friday slumped to their worst week since early April. Back then, the market fell because of President Trump’s sky-high tariffs. This time, the driver is the president’s deficit-increasing domestic policy bill.

The S&P 500 index fell 0.7 percent on Friday, adding to losses since Tuesday and taking its slide for the week to 2.6 percent. The drop on Friday came as Mr. Trump threatened even steeper tariffs on the European Union, and warned Apple that unless it manufacturers phones in the United States, it will also face new tariffs.

But it was the market’s concerns about the deficit that dominated the week and were likely to persist as the budget bill makes its way through the Senate. The bill, which cleared the House of Representatives on Wednesday, extends tax cuts, adds some new ones, and fails to significantly reduce spending.

The concern for investors is that if the government doesn’t rein in spending, it will have to borrow heavily to continue financing its operations. That worry has fueled a cycle of rising yields in the government bond market and falling stock prices.

“Markets remain hostage to policy out of the White House,” said Matt Eagan, a portfolio manager at Loomis Sayles. “While tariffs make headlines, it’s the deficit that matters most.”

Yields eased slightly on Friday but remained notably higher than where they began the month: notably, the yield on the 30-year Treasury bond this week rose above 5 percent for the first time since October 2023.

Thank you for your patience while we verify access. If you are in Reader mode please exit and log into your Times account, or subscribe for all of The Times.

Thank you for your patience while we verify access.

Already a subscriber? Log in.

Want all of The Times? Subscribe.